What Kind of Back Tax Relief Does the IRS Have Right Now?

- Posted by Joshua Sells

- On November 23, 2020

- IRS Back Taxes, IRS Tax Attorney, IRS Tax Debt, IRS Tax Relief, Offer in Compromise, Ohio Tax Attorney, Tax Settlement

What Kind of Back Tax Relief Does the IRS Have Right Now?

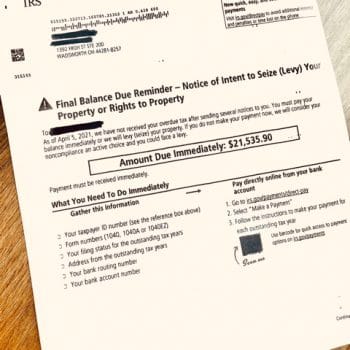

The IRS recently updated its COVID-19 Taxpayer Relief Initiative . Although they could have done more, there are still some great options if you are dealing with IRS back tax. Unfortunately, the IRS has started to issue federal tax liens and levy bank accounts. You may want to jump on these new back tax resolution options if you have IRS back tax.

IRS Tax Debt Forgiveness through the Offer In Compromise

The IRS is offering flexibility if you are unable to meet the payment terms of an accepted Offer in Compromise. When an Offer in Compromise (that is the tax settlement – – – aka back tax forgiveness) is accepted by the IRS, a taxpayer has a certain amount of time to send their settlement check. Otherwise, the IRS will reject the settlement. This causes the back tax to come roaring back.

This additional flexibility is welcome relief if you are in the process of satisfying an accepted Offer in Compromise. We would have liked some additional flexibility for estimated tax payment requirements, but this is definitely welcome relief.

IRS Back Tax Relief through Long Term Payment Plans

IRS Installment Agreements have always been a quick way to get rapid tax relief. Monthly payments that are automatically taken from your bank account offer many taxpayers relief from levies and garnishments. Under the new taxpayer relief initiative, certain qualified individual taxpayers who owe less than $250,000 may set up installment agreements without providing a financial statement. That means you don’t have to jump through hoops with those complicated 433-A or 433-F financial disclosure forms! As long as your proposed payment satisfies the back tax debt before the collection statute expiration date (aka the statute of limitations), the IRS will accept your monthly payment proposal.

Additionally, the IRS may not file a tax lien if your balance is under $250,000. They keyword here is “may” – they always have discretion to and, if you had a prior balance, the lien has likely automatically been filed. One of the biggest new changes is that if you had a new balance this year, it will automatically be added to an existing installment agreement instead of causing your agreement to default. This is a much needed enhancement!

Other Recent IRS Back Tax Relief Options

In addition to the updated Offer in Compromise tax settlement and installment agreement options, there are other back tax resolution options such a financial hardship and penalty abatement.

If you are looking to hire an IRS Tax Attorney to handle your IRS back tax relief, check out our Frequently Ask Questions section for more information, or feel free to ask Josh a question below.