Surviving the Delinquent Tax Nightmare: Expert Insights Unveiled

- 0 Comments

- IRS Back Taxes, IRS Tax Attorney, IRS Tax Debt, IRS Tax Relief

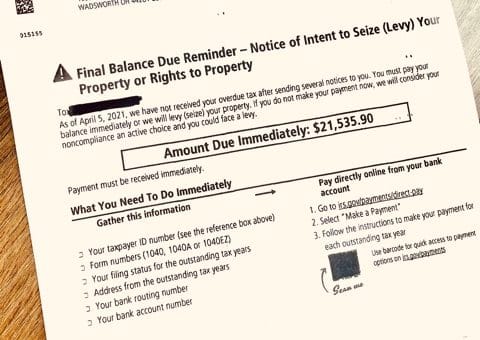

Surviving the Delinquent Tax Nightmare: Expert Insights Unveiled An Informative Guide for Ohio Residents Who Owe the IRS Back Taxes If you are an Ohio resident who owes the IRS back taxes, you’re not alone. Many individuals find themselves in a similar situation, facing the overwhelming challenge of dealing with delinquent taxes. We want to […]

Read More